image by Zoltan Tasi

Our 15 selected projects average is down at 0.34 from last month 0.37 (i.e. $0.34 market cap for every $1 (TVL) value locked.

The following 3 projects have below average ratios at 2 Oct and we’ve included the data from Sep as reference: $CRV, $COMP and $BAL. YFI is a worthy mention, going from a MCap/TVL ratio of 0.3 to 0.23 in October.

From a market cap. perspective, $UNI is still way out ahead, with $CRV showing strength.

Market Cap observation (UNI & CRV)

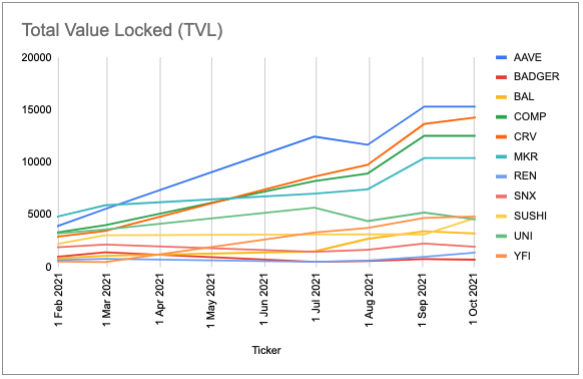

TVL chart shows a consistent increase in assets locked up on $AAVE, $CRV, $COMP and $MKR. Outside of these 4 projects, DeFi assets also seem to be flowing to $BAL.

TVL - Total value Locked

DISCLAIMER

This publication is general in nature and is not intended to constitute any professional advice or an offer or solicitation to buy or sell any financial or investment products. You should seek separate professional advice before taking any action in relation to the matters dealt with in this publication. Please also note our disclosure here